State of California Smog Check Program Requirements

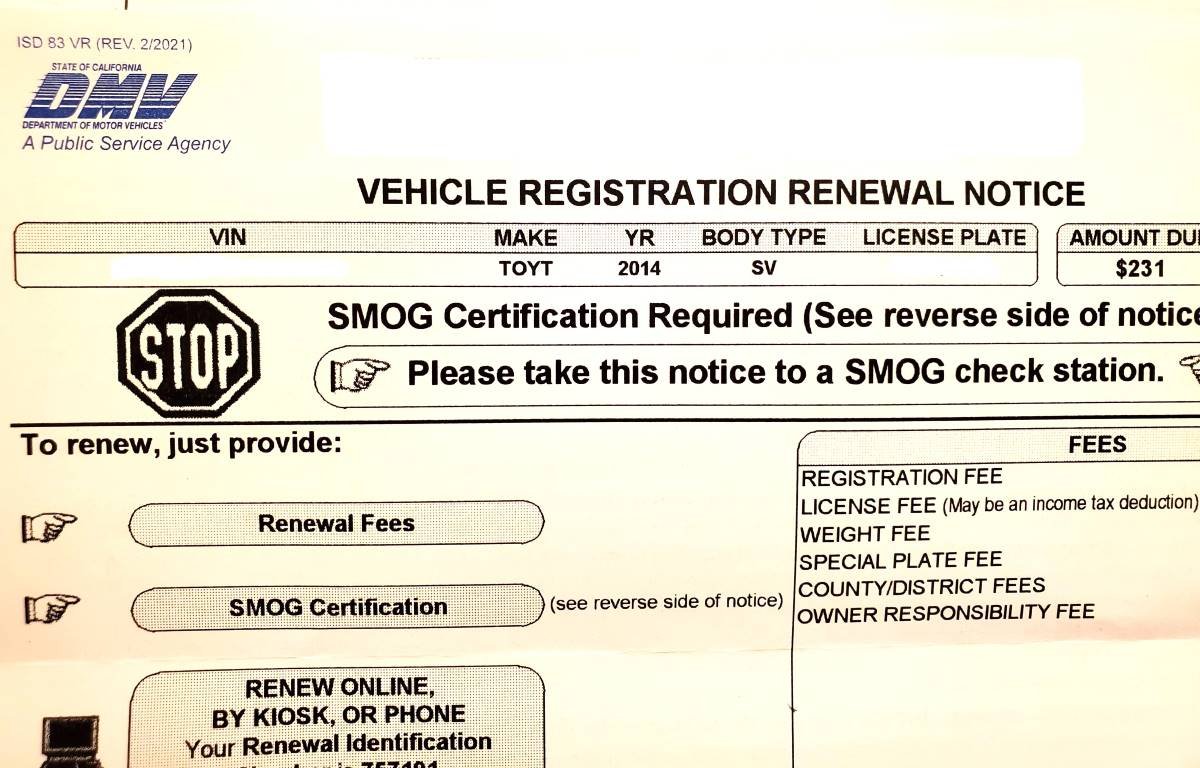

/I was about to renew my auto registration online as I’ve done mindlessly for many years, until I looked more carefully at the notice and I read the dreaded “STOP: SMOG Certification Required” imprinted near the top of the notice. I’ve owned the minivan for eight years and wondered, why NOW!?

The California Smog Check Program has been in place since 1984.and is administered by the Bureau of Automotive Repair, or BAR. BAR licenses independently owned smog check stations throughout the state.

THE BASICS

The BAR indicates a smog check is required EVERY OTHER YEAR as part of the vehicle registration process. It is also required when a vehicle changes ownership or when it is registered for the first time in California.

Every other year? That can’t be, because this was the first time I’ve been asked to do a smog check in the eight years since I owned the car, right?

The BAR goes on to explain that gasoline-powered vehicles, hybrid vehicles and alternative-fuel vehicles that are model year 1976 and newer require a smog check, with the following exceptions:

Eight model years and newer do not require a biennial smog check.

Four model years and newer do not require a change-of-ownership check.

In English, this means you need to add 8 to the model year of your vehicle to determine when you need to start doing biennial, or every other year, smog checks. For example, my 2014 minivan needs a smog test starting in 2022. And if I purchase a used 2018 vehicle in 2022, it would be subject to a smog check.

SMOG CHECKS ARE NOT REQUIRED FOR:

1975 or older vehicles

Eight model years or newer vehicles

Four model years or newer vehicles changing ownership

Electric vehicles

Motorcycles

Tricycles (OK, I decided to throw this in to make sure you were paying attention.)

Diesel vehicles model year 1997 and older

Diesel vehicles with a gross weight of over 14,000 pounds

OTHER

Wait a second, my 2014 minivan is eight years old. Why this year, not next year, for the first smog check? Because the state assumes that model years are released in the calendar year prior to a vehicle’s model year. So regardless whether I purchased my brand new 2014 minivan in 2013 or 2014, it is assumed to be one model year old in 2014. That means, it is theoretically turning nine model years old in 2022. Hence, the need for a smog check for the first time in 2022.

If your smog check passes, hurray! The smog “certificate” is electronically submitted to the DMV and you are on your way to renew your vehicle registration. If it fails the test, you need to get it fixed, or you can visit a “smog check referee” for a second opinion.

“But I don’t want to get a smog check!” Well, then buy an electric car or a model 1975 or older car. Or buy a new car before your car turns eight model years old. Or move to a state like Alabama that doesn’t require emissions testing.