Volunteer Income Tax Assistance Locations in Ventura County

/The Volunteer Income Tax Assistance (VITA) program recruits volunteer tax preparers to provide free preparation of federal and state income tax returns to taxpayers with incomes of $67,000 or less in 2024. VITA benefits these taxpayers by eliminating the cost of commercial tax return preparation and by securing valuable tax credits such as the Child Tax Credit and EITC.

Local VITA location sites are as follows (see this IRS link for details, including dates and times and contact information for making appointments, when required):

Newbury Park Library, 2331 Borchard Road - Wednesdays 10am to 4pm, 2/5/25 to 4/9/25. Appointments not required.

Conejo Creek South Park Community Building, 1350 E. Janss Road, Thousand Oaks - Mon-Fri 8:30am to 4pm, 2/3/25 to 4/15/25. Appointments not required.

Moorpark College - 2/1/25 to 4/30/25. Appointments are required. www.moorparkcollege.edu/departments/academic/business-administration/program/accounting/VITA

East County Job and Career Center, 2900 N. Madera Road, Simi Valley - 2/5/25 to 4/30/25. Appointments are required.

Oxnard College, 4000 South Rose Avenue - 2/6/25 to 4/30/25. Appointments are required.

United Way of Ventura County, 702 County Square Drive #100, Ventura. 2/4/25 to 4/30/25. Appointments are required.

Ventura Community Service Center, 4651 Telephone Road, 2nd Floor. Appointments are required. 2/1/25-4/30/25

Also see www.ventura.org/human-services-agency/tax-preparation

What to bring:

Proof of identification (photo ID)

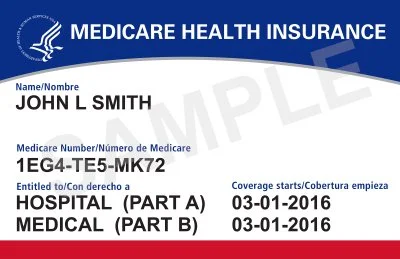

Social Security cards for you, your spouse and dependents

An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

Proof of foreign status, if applying for an ITIN

Birth dates for you, your spouse and dependents on the tax return

Wage and earning statements (Form W-2, W-2G) from all employers

Pension, Retirement and Social Security Income statements (Forms 1099)

Interest and dividend statements from banks (Forms 1099)

A copy of last year’s federal and state returns, if available

Proof of bank account routing and account numbers for direct deposit such as a blank check

Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number

Forms 1095-A, Health Insurance Marketplace Statement

Copies of income transcripts from IRS and state, if applicable

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

www.irs.gov/individuals/checklist-for-free-tax-return-preparation

The IRS partners with software companies to provide “IRS Free File” guided tax software for taxpayers with adjusted gross income (AGI) or $84,000 or less for the 2024 tax year. Learn more at apps.irs.gov/app/freeFile. Providers for 2024 filings include FreeTaxUSA, 1040.com, FileYourTaxes.com, 1040NOW, TaxAct, OLT.com, TaxSlayer, and ezTaxReturn.com.