An Update on High Dividend Paying Stocks

/ Thirteen months ago I highlighted some stocks that pay decent dividends, as an alternative to low yielding bank CDs and bonds. Since then, the market has made a nice comeback, up over 40% overall. A monkey could have made money in this market by throwing banana slices at ticker symbols on CNBC.

Thirteen months ago I highlighted some stocks that pay decent dividends, as an alternative to low yielding bank CDs and bonds. Since then, the market has made a nice comeback, up over 40% overall. A monkey could have made money in this market by throwing banana slices at ticker symbols on CNBC.

The good news is that the 19 stocks highlighted grew by nearly 40%, even before taking into account the 5% to 6% dividends paid out during the period!

While I can't predict where the stock market is headed (seems like it should be taking a breather at some point, but who knows...), let's take a fresh look at these stocks!

- Altria (Symbol: MO) A year ago at $17 it yielded 7.9%. Today at $21 it yields 6.6%. Still worth a look profiting off smokers of the world!

- BP plc (BP) Yielded 8.8% at $38 a year ago but today it stands at $60 and at that price yields 5.7%. I suppose this is worth buying for the yield. Heck, fixed rate mortgages are still less than that.

- Aflac (AFL) At $15 it yielded 7.5%. But holy smokes! Stock is now $57 and yields just 2% at that price! I'd hold my shares purchased at lower prices but would hesitate buying more at this point.

- Eli Lilly (LLY) Lilly is now at $37 and yields 5.3%, slightly less compelling than the 6.5% yield at $31 a year ago but seems safe.

- GlaxoSmithKline (GSK) Yielded 6.8% at $29 last year but today yields 5.8% at $39. I'd consider buying more. Our population is getting older and we need our drugs :<

- Nicor (GAS) Yielded 6.4% at $29 last year and yields 4.3% at $44 today. Nice 50% bump up in price for a utility company! I'd hold these.

- Merck (MRK) Merck now yields 4.1% at $36 per share vs 6.3% at $27 a year ago. Hmm, doesn't excite me too much but 4% is not bad. This is about the same as Pfizer's (PFE) current 4.2% yield at $17 per share.

- H.J. Heinz (HNZ) At $33 yielded 5.1% last year. Today yields 3.7% at $46.

- Kraft Foods (KFT) At $23 yielded 5.2%; today yields 3.8% at $31.

- Coca-Cola (KO) At $41 yielded 4%; today yields 3.2% at $55. I guess I'd hold on to these last 3 food stocks as everyone's gotta eat.

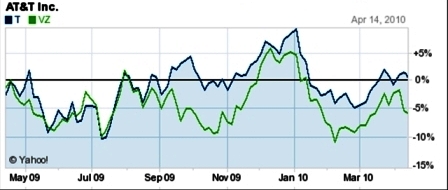

- AT&T (T) At $24 yielded a hefty 6.7%; today stock is still only at $26 even with a year's worth of iPhones under its belt, yielding a still hefty 6.4%.

- Verizon (VZ) At $28 yielded 6.8% and at today's $30 still yields 6.3%. I like these big communications stocks for long term holdings, even though they didn't participate in the nice recent market runup.

- Southern Co. (SO) This natural gas provider yielded 6.3% at $27 last year and 5.2% today at $34. I like boring but stable, high-yielding stocks like this in a balanced portfolio.

- Johnson & Johnson (JNJ) Maker of Q-Tips and Band Aids yielded 3.8% at $51 and today yields 3% at $65. On the low side but I like JNJ as a long-term hold in my portfolio.

- Kimberly-Clark (KMB) Maker of Kleenex, Huggies and Depends at $46 yielded 5.3% last year vs today's 4.3% yield at $61/share. Another long-term hold in my portfolio. I like them and plan to buy more. Who knows, in another 20 years I may be in Depends myself.

- Microsoft (MSFT) MSFT nearly doubled from $17 to $31 per share in a year and as a result its yield dropped from 3.1% to 1.7%. I'm holding but not buying more.

- Bristol-Myers Squibb (BMY) Yielded 6% at $21 last year; 4.9% at $26 today.

- Procter & Gamble (PG) Yielded 3.5% at $47 and today yields 2.8% at $63.

- iShares Investment Grade Corporate Bond ETF (LQD) invests in high yielding corporate bonds and currently has a yield in the 5% range.

- Exelon (EXC) is another nice utility stock not on the previous list that yields 4.7% at its current $45 price. Worth a look.

So there ya have it! Take a look at these for inclusion in a balanced portfolio. I like high yielding stocks because they generally let me sleep better at night. That said, as with all investments, there is no guarantee of a return, so don't blame me if you don't make money on these :>